New Year brings new taxes and fees. What changes will Ukrainians face starting January 1, 2025?

The new year 2025 has brought price increases for Ukrainians. Such surprises under the Christmas tree should be expected by individual entrepreneurs (FOP, as the Ukrainian abbreviation is often used), car owners, landline phone users, and smokers.

People with disabilities will now receive certificates through a new procedure, as from January 1, the medical and social expert commissions (MSEC) will be abolished nationwide. "Telegraph" has gathered all the changes that will affect the lives of Ukrainians starting from the first month of this year.

How taxes will increase

From January 1, the military tax on individual salaries has increased from 1.5% to 5%. This increase does not apply to military personnel.

For individual entrepreneurs in the first, second, and fourth groups, a military tax of 10% of the minimum wage (currently 800 UAH) is introduced. For third group FOPs, the military tax will be 1% of their income.

Additionally, "FOPs" will again be required to pay the single social contribution (USC). The monthly payment will amount to 1760 UAH (which is 22% of the minimum wage). This requirement was suspended from March 2022, and during the martial law period, USC payment became voluntary. FOPs located in temporarily occupied territories will have the right not to pay this tax.

Car insurance will become more expensive

The amount of mandatory car insurance has increased. It will gradually rise to align with actual costs (prices for imported spare parts are being updated, while the insurance amount in UAH has remained "frozen" for several years).

Starting in 2025, the limits will increase to 250,000 UAH for property damage (with a maximum of 1.25 million UAH per incident) and up to 500,000 UAH for health damage (maximum – 5 million UAH per incident). Insurers will independently determine the factors affecting the policy cost for each driver (for example, driving experience, age, or accident history).

Previously, the legislative limits were set at: 160,000 UAH for damage to third-party property; 320,000 UAH for damage to the life and/or health of third parties.

The deductible (the amount the at-fault driver must cover in case of an accident) is being abolished. If the driver of the insured vehicle is not at fault in the accident, their insurance company will compensate the damage, but will recover the costs from the insurer of the other party – the at-fault driver.

Gasoline

Starting January 1, Ukraine is expecting the next phase of excise tax increases on fuel for gas stations: 271.7 euros per thousand liters of gasoline, 215.7 euros per thousand liters of diesel, and 173 euros per thousand liters of gas.

According to Finance Minister Serhiy Marchenko, the price of gasoline for ordinary Ukrainians remains unchanged. Artem Kuyun, an analyst at the A-95 Consulting Group, predicts that starting January 1, Ukrainians should not fear an increase in autogas prices. The excise on LPG will rise by only a few euros from January 1, 2025, stating that these figures would not lead to a price of 40 UAH per liter.

The next phase of increases is planned for 2026.

Transportation tariffs for gas will rise

From January 1, gas transportation tariffs for domestic consumers in Ukraine will increase fourfold (by 305%). This was reported at a meeting of the National Commission for State Regulation in the Sphere of Energy and Public Utilities (NKREKU).

Currently, there is a moratorium on price increases for the population; however, the industry will feel the consequences of this decision. The decision was made due to the cessation of Russian gas transit through Ukraine.

Immediately after the announcement of the tariff increases, there was a lively reaction, particularly in the parliament, where the commission was asked to justify the calculations.

It’s not a fact that this situation will impact household consumers. This was stated to "Telegraph" by Ukrainian expert in international energy relations, President of the Globalistics Center "Strategy XXI" Mykhailo Gonchar. According to him, prices for Ukrainian households are not set by the Gas Transmission System Operator. Domestic consumers do not have relationships with the gas transportation system. Regional gas companies are responsible for price increases for the population, but they will not increase tariffs proportionally to the rise in gas transportation costs.

"Some increases will occur. But to say they will be multiple is incorrect. It definitely will not happen," Gonchar added.

Combatant status and reservation

An automatic provision of combatant status (UBD) is being introduced: military personnel performing combat missions will no longer need to submit paper documents.

After receiving the UBD status, the defender will be able to generate an e-certificate in "Dія", which can be presented starting January 2025.

The Cabinet has also extended the reservation period following the cyberattack on the Ministry of Justice registries, making it valid until January 20, for cases where the deadlines expired on December 20. If the reservation ended by December 19, i.e., before the cyberattack, employers will be able to restore it after the registries resume operation.

MSEC will no longer exist

Instead, starting January 1, there will be new expert commissions in cluster and super-cluster hospitals.

These new commissions will selectively review patient cases. Neither the patient nor the commission will know which doctors are going to consider the case. A digitized system will ensure transparency in all decisions.

To undergo evaluation, a person should consult their doctor – a specialized physician. This doctor will refer them for evaluation based on the following criteria:

- The expiration of the repeat examination period

- Stable or irreversible nature of the disease

- Prolonged temporary disability continuously up to 120 days or within a year up to 150 days.

- Special cases: tuberculosis or critical medical conditions not requiring waiting.

Previously established statuses for persons with disabilities will remain unchanged.

Paid services in hospitals

Starting January 1, state and municipal healthcare institutions will charge for certain services not covered by the medical guarantees program.

- Provision of medical services not at the place of residence or stay of the patient, unless caused by their condition;

- The ability to independently choose a doctor when receiving specialized medical care in a planned manner in a hospital;

- Staying in a room with enhanced comfort and service at the patient's request.

Payment will be required for visits without a doctor's referral, except in cases where it is not required.

The cost of additional services will be determined by the medical institution independently. Payment for medical assistance can be made only in non-cash form to the official account of the institution.

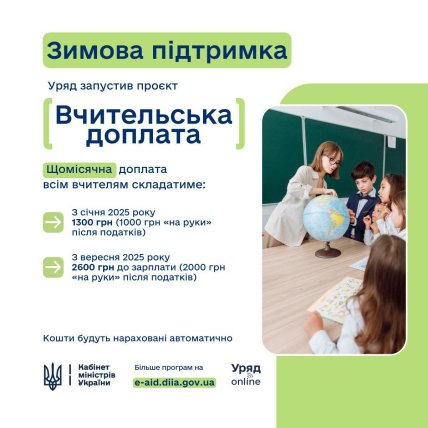

Teacher's allowance of 1000 UAH

Starting January 1, 2025, the Government is introducing a monthly teacher's allowance of 1300 UAH in addition to the base salary. Teachers will receive 1000 UAH after tax deductions.

The Cabinet promises that payments will be processed automatically, and teachers will not need to submit applications to receive the allowance. This will cost the budget 4.6 billion UAH.

Cigarettes may become more expensive

In Ukraine, there are plans to increase excise tax rates on tobacco products. As of December 27, bill No. 11090 has been submitted for signature to the president.

If the document is signed, in 2025, the excise tax on cigarettes and other tobacco products will be linked to the euro. Before the law was passed, excise rates were set in UAH.

In the upcoming year, the excise for cigarettes will increase from 57.4 euros to 78 euros per 1000 cigarettes, and by 2028, the tax will reach 90 euros. For consumers, this means that each pack of cigarettes will cost at least 78 UAH in excise (at the current NBU exchange rate). This means the price could rise by 40 UAH for one pack, calculated by MP from "Holos" Yaroslav Zhelezniak.

Additionally, the adopted law makes an exception for tobacco products for electronic heating (such as IQOS or PLOOM) – the tax rate for them will be lower than for regular cigarettes.

Earlier, the Telegraph reported that sugar and chocolate are becoming more expensive, and prices