Does the new tobacco excise law support sponsors in Russia? Here are three questions raised by this legislation.

On December 4, the Verkhovna Rada adopted in the second reading bill No. 11090 concerning a significant increase in excise tax on tobacco products. Interestingly, the justification for the necessity of the bill does not mention the goal that should ideally be decisive in the adoption of this act – to assist in reducing tobacco consumption among Ukrainians. The explanatory note states that the implementation of this bill will increase budget revenues.

However, even from this purely "economic" perspective, the substantial difference in excise rates for "traditional" cigarettes and tobacco-containing products for electronic heating (TIEN) appears somewhat odd. For TIEN, the deputies inexplicably decided to set the excise tax 20% lower. If the parliamentarians' reasoning was purely economic, why refuse the extra billions that could be generated by the excise on "sticks"? Did they consider whose pockets this difference will eventually line?

"Telegraph" investigated why legislators might have overlooked the impact of the bill on citizens' health and whether the lower excise for TIEN will indeed benefit Ukraine and Ukrainians.

The Economics of the Law

Currently, the excise on tobacco products in Ukraine is paid under a mixed system. In fact, there are two excise taxes that apply to them, which are then summed. The first is an ad valorem tax based on a rate of 12% (applied only to cigarettes (including those without filters) and cigarillos, paid, so to speak, based on the price of each pack). The second is a specific tax, expressed in absolute monetary values, which is paid on all tobacco products depending on the type of product – per 1000 cigarettes or sticks, 1 kilogram of tobacco-containing products, or 1 liter of the corresponding liquid.

European directives stipulate that in the case of cigarettes, the sum of these two taxes cannot be less than 60% of the weighted average retail price of cigarettes and simultaneously less than 90 euros per thousand pieces. For comparison, due to the depreciation of the hryvnia, this tax in Ukraine currently amounts to only about 60 euros per thousand pieces, which is one-third less than in the EU.

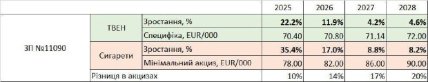

Consequently, the provisions of bill No. 11090 foresee a significant, albeit gradual, increase in the total tobacco excise in Ukraine and ultimately its establishment by 2029 for "traditional" cigarettes at a minimum level of 90 euros (the calculation of this tax in euros is another innovation of the law. — Ed.) per 1000 pieces. The schedule for the annual increase in the total excise, including the provisions of the final version of the bill voted on by the Verkhovna Rada, can be seen in the following table.

As shown in the table, starting from 2025, the minimum excise tax on cigarettes will increase by 35.4%, meaning a price increase of about 40 hryvnias for Ukrainians per pack. In the following three years, the price will rise by approximately the same amount.

At the same time, as can be seen from the same table, there is a significant imbalance between the growth of excise on cigarettes and TIEN (colloquially known as "sticks"). The final excise rate on tobacco-containing products for electronic heating will be 20% lower than the corresponding rate for cigarettes.

According to experts, this will mean that during the period from 2025 to 2028, the budget will receive approximately 19-20 billion UAH less compared to the amount that would have been collected if the excise rate had been equalized. And this does not account for losses after 2028.

"Our calculations show that this 20% discount on tobacco products for heating will cost the state budget of Ukraine 3 billion hryvnias next year. Overall, during the period from 2025 to 2028, it will be about 19 billion hryvnias. Beyond that, each subsequent year, this gap will cost the budget around 7 billion hryvnias. Of course, we advocate for the complete removal of this product from the Ukrainian market because it is unnecessary and harmful to health. But if it exists, it is quite strange, in the context of a major war and budget deficits, to refuse this money," commented the executive director of the NGO "Center for Civil Representation 'Life'" Dmytro Kupria.

What led parliamentarians to grant such preferences to tobacco product manufacturers for IQOS, Ploom, glo, and other similar brands?

What International Organizations Really Say

Formally, one of the reasons for the different taxation of cigarettes and TIEN was allegedly a requirement from the International Monetary Fund. As reported by "Left Bank", during one of the last meetings of the working group on tobacco excise, the head of the tax committee of the Verkhovna Rada, Daniil Hetmantsev, stated this.

"Having received an official position from them, we, unfortunately, as much as we would like to do what we want, can only do so when we finance ourselves," the publication quotes the committee head.

However, Hetmantsev seems to be being disingenuous here. Because the mentioned response from the IMF, which came into possession of the NGO "Life," does not contain a requirement for reduced taxation for "sticks," but only indicates that it does not contradict the Fund's position on this matter. At the same time, a tax rate of 90 euros per 1000 pieces is quite possible for such products.

"For HnB products (tobacco products for heating), we proposed a rate based on comparable tobacco weight for these products and recommended using a rate within the range of 45 to 90 euros per 1000 tobacco sticks, noting that a balance must be found between financial goals and health goals. The rate you proposed of 72 euros per 1000 sticks in 2028 falls within this range," states the translation of the IMF's response.

The second reason, briefly mentioned in the explanatory note to the bill, pertains to the alleged European practice of applying a lower tax on "sticks" due to presumably lower risks associated with such products compared to traditional cigarettes.

"According to national approaches to excise taxation of newer tobacco products in most European Union countries, which allow for potentially reduced health risks from their consumption, the provisions of the draft act propose to introduce a reduced excise tax rate on TIEN compared to cigarettes," the explanatory note states.

It is worth noting that there are indeed links to studies available online claiming that, for instance, IQOS supposedly emits 95% fewer harmful substances than regular cigarettes.

But there is one "but" – usually, such studies are funded by the manufacturers of these products themselves. Consequently, they raise significant doubts regarding their reliability, especially following investigations into how tobacco magnates distort research results. For example, the high-profile investigation "Science for Sale: Philip Morris's Payments Network to Fund Tobacco Research" is based on information from an insider scientist.

At the same time, as already mentioned, the explanatory note to bill No. 11090 does not mention a word about the goal of increasing excise taxes on tobacco-containing products, which should have been the primary consideration in adopting this document: concern for the health of Ukrainians. Meanwhile, the EU directive 2011/64/EU, which is cited as a basis for its adoption, places the thesis of health preservation among its top priorities.

"The Union's tax legislation concerning tobacco products must ensure the proper functioning of the internal market while also maintaining a high level of health care in accordance with the requirements of Article 168 of the Treaty on the Functioning of the European Union, considering that tobacco products can cause serious harm to health and that the Union is a party to the World Health Organization Framework Convention on Tobacco Control (FCTC)," states the relevant directive.

Additionally, the EU directive also notes that products within the same category must have equal competitive conditions.

"Regarding excise taxes, the harmonization of the structure should, in particular, lead to competition among various categories of tobacco products belonging to the same group, untainted by the consequences of tax assessments, and therefore to the opening of national markets of member states," states the EU directive.

Thus, considering that TIEN are currently direct competitors of regular cigarettes, it appears that the Verkhovna Rada simply ignored the imperative of the European directive. But that's not all.

"The Forgotten Main Question

If legislators had decided to outline the main goal in the justification of the bill – the reduction of